Financial Wellbeing

The facts

Financial wellbeing is all about people’s control over their finances, their ability to respond to financial unpredictability and unexpected expense, and their ability to meet financial goals and make choices that allow them to enjoy life.

Just as you can take steps to improve physical health, you can also take some simple steps to feel more in control of financial wellbeing. Financial distress is a major cause of stress and anxiety, which can affect performance and productivity at work. With increases in the cost of living, financial wellbeing is more important than ever.

Simple steps

The Chartered Institute of Personnel and Development (CIPD) recommends 3 simple steps that any employer can take:

- let your workforce know that they can get free, confidential and independent money and debt advice from the government-endorsed MoneyHelper service

- make sure your workforce is fully aware of all the benefits you currently offer and how to make the most of them

- begin a dialogue with employees and line managers about the financial challenges and opportunities faced by them and the business and suggests the following actions:

Actions

CIPD suggests the following actions:

- directing employees to internal and external sources of help

- encourage ‘savvy consumers’ e.g. using comparison sites and consumer forums

- promote the use of online pension, budget and saving calculators/modellers

- host learning days on particular financial topics

- use an employee champion to deliver financial well-being messages, information and guidance sources to their peers

Signposting

MoneyHelper is the easy way to get free help for all your money and pension choices. Here, you’ll now find support previously provided by the Money Advice Service and The Pensions Advisory Service, as well as Pension Wise:

- Clear money and pension guidance

- Free, impartial help that’s all in one place

- Easy to use and backed by government

- Signposts to further, trusted services, if needed

- Based on your circumstances

- Available online or over the phone

Open to everyone, MoneyHelper is helping people to clear their debts, reduce spending and make the most of their income; to support loved ones, plan ahead for major purchases and find out about entitlements; to build up savings and pensions, and know their options.

Their Beginner’s guide to managing your money includes guidance on:

- How to set up a budget

- Getting your budget back on track

- Paying off loans and credit cards

- Set a savings goal

- If you’re overwhelmed by your debts

Money Saving Expert also provides information on pensions and future planning, budgeting, household bills and debt help

Northumberland Community Bank Northumberland Community Bank for Loans, Savings & Payroll

Durham Savers Financial Ability - Durham County Council

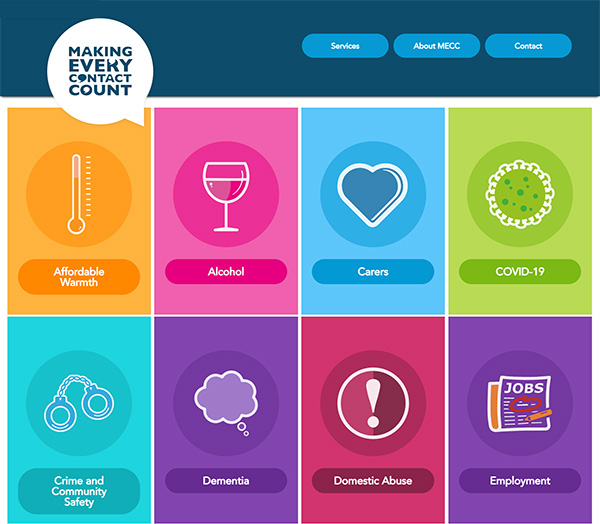

The MECC gateway is a great website with lots more information and resources you can tap into on a huge range of health and related topics, including financial wellbeing